February 20, 2024

On November 15, 2023, the Governor’s Office of Management and Budget (GOMB) released the Illinois Economic and Fiscal Policy Report. The report describes updates to the FY2024 budget compared to the enacted budget projections, including details about the State’s increase in total revenues and a slight reduction in expenditures. In recent months, the Commission on Government Accountability and Forecasting (COGFA) had also provided additional details about the State’s fluctuating revenue sources between FY2023 and FY2024 as well as projections for the remainder of FY2024 in their recent monthly briefings. Ahead of the release of the Governor’s proposed budget on February 21, this blog post will review the projections for FY2024 and FY2025 contained in the GOMB report.

The FY2024 Enacted Budget

On June 7, 2023, Governor JB Pritzker signed the State’s FY2024 budget, which consists of four bills, into law. The enacted budget totaled $50.4 billion, which is a $786 million or 1.6% increase from the original FY2024 budget proposal total of $49.6 billion. The projections changed due to an increase in revenue for individual income taxes as well as an increase in spending in the areas of education, human services, and healthcare. The FY2024 budget made investments in education including an additional $600 million to the Illinois State Board of Education (ISBE) to support educational programs. Of the $600 million total, $75 million supports the expansion of early childhood education services and $45 million supports a teacher pipeline grant program.1 There was also an increase of $350 million for K-12 evidence-based funding (EBF) formula, which brought the total annual base funding increase to $1.443 billion.

The FY2024 budget increased funding for higher education by $100 million through the Monetary Award Program (MAP), which serves as a need-based assistance program for college students, and by $15 million through the AIM HIGH program. The budget also included an additional $700 million for the Department of Healthcare and Family Services to address increased costs for Medicaid, related program costs and half year rate increased as the enhanced federal Medicaid match declines.2 Additionally, there were significant funding, including nearly $75 million for the Department of Children and Family Services (DFCS) to hire staff, the expansion of training and protection, scholarships for youth and improvement of facilities.in other human services agencies, including nearly $75 million for the Department of Children and Family Services (DFCS) to hire staff, expand training and protection as well as scholarships for youth, and to improve facilities.

GOMB’s November Estimate

The Illinois Economic and Fiscal Policy Report estimated that General Funds revenues in FY2024 will increase by $1.4 billion from the enacted budget. This estimate included some upward revisions to the FY2024 projected State-source tax revenues of $604 million over the enacted budget. The increase is due to corporate income taxes and sales tax collections exceeding what was budgeted through the first four months of the year. Additionally, the Income Tax Refund Fund is forecast to end FY2023 with a larger than expected balance, resulting in a transfer of $255 million due to stronger than expected income tax performance during the prior fiscal year. All other sources are also projected to increase by $401 million, or 15.3%, to a total of $3.0 billion when compared to the enacted budget total of $2.6 billion. Transfers in from the lottery are projected to increase by $41.0 million due to stronger than anticipated lottery play and other transfers by $355 million. Federal revenue is estimated to increase by $405 million due to a one-time withdrawal for reimbursement on expenditures for certain waiver services within the Department of Human Services (DHS) over the last two years. The GOMB report notes that most of the FY2024 revenue forecast revisions are assumed to be one-time in nature.

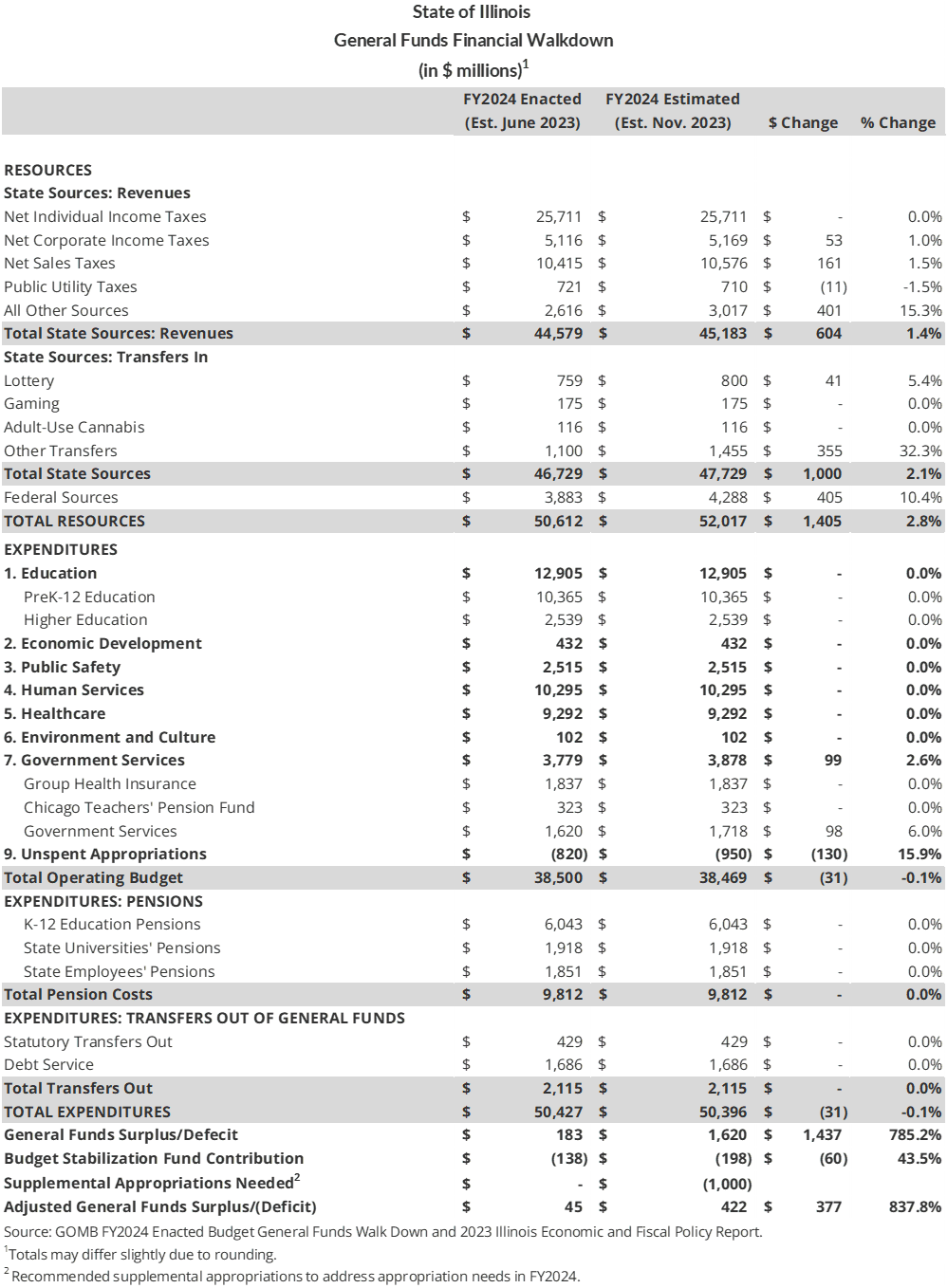

The following table compares the FY2024 enacted budget and the November estimate.

Fiscal Year 2024 Operating Revenues

The November 2023 estimate projects $47.7 billion in State resources, plus $4.3 million in federal sources, for a total of $52.0 billion in General Funds resources. The General Funds support the regular operating and administrative expenses of most State agencies and are the funds over which the State has the most control. The operating budget also includes Other State funds, which accounts for activities funded by revenue sources that may only be used for specific purposes, and the Federal Funds, which support a variety of State programs with federal revenues. The remaining revenues that are not included in the General Funds are restricted for specific purposes, shared through revolving funds between government agencies, held in trust or generally not available for discretionary spending by the General Assembly.

The table above shows the change in General Funds revenues between the FY2024 enacted budget and the FY2023 November projection. The increase is mainly due to increases in corporate income taxes, sales taxes, other sources, and transfers in, which also incorporates economic projections from IHS insight, a national economic forecasting firm. As noted above, total revenues were projected to increase by $1.4 billion over the enacted amounts, most of which is expected to be one-time in nature.

Fiscal Year 2024 Operating Expenditures

The FY2023 November estimate shows General Funds expenditures declining slightly, by $31 million from $50.4 billion in the FY2024 enacted budget. The decrease is mainly due to an increase in unspent appropriations of $130 million, or 15.9% of the FY2024 enacted budget total of $820 million.

As a result of the projected increase in FY2024 revenues, the November estimate projects a $1.4 billion increase in the General Funds surplus, bringing the projected surplus to a total of $1.6 billion. The Governor’s office is proposing to increase the contribution to the Budget Stabilization Fund by $60 million from $138 million in the enacted budget for a total of $198 million. The Office has also identified and proposed supplemental appropriations totaling $1.0 billion that would offset revenue gains from the FY2024 General Fund budget pressures. These pressures include increased case loads at the Department on Aging and DHS, funding needed to cover delayed FEMA reimbursements to HFS for pandemic-related nursing staff support costs at hospitals, outstanding bills at the Department of Innovation and Technology, increased group insurance costs at the Department of Central Management Services, and potential spending pressures related to asylum seekers at DHS.3 After accounting for the supplemental budget pressures, the November estimate projects the adjusted General Funds surplus to total $422 million, which is an increase of $377 million from the enacted budget.

Five-Year Fiscal Forecast

The Illinois Economic and Policy Report based its longer-term revenue projections on the September 2023 IHS baseline forecast. According to the report, the forecast reflects signs of continued growth in the economy as reflected in areas of ongoing strong employment and consumer spending. The forecast does not factor in a recession in the short-term and as of November 2023 the rate of growth for Illinois was expected to be moderate and stable between fiscal year 2024 and 2026. In fact, wage and salary growth are forecast to improve as the labor market relaxes, despite a potential decline in future years.4

The Governor’s Office of Management and Budget (GOMB) and the Illinois Department of Revenue (IDOR) estimated in November 2023 that base General Funds revenues for FY2025 will total $51.5 billion, which is $48 million less than the November 2023 estimated total of $52.0 billion. The impact of the ongoing shift of revenues generated by the state sales tax on motor fuel from the General Funds to the Road Fund will continue to be reflected in FY2025 and in future years. In FY2025, approximately $844 million in total motor fuel tax revenue will be diverted. After the end of the phase-in in FY2026, the entire five percentage point State sales tax on motor fuel will be deposited into the Road Fund. Fiscal year 2025 federal reimbursements will also be lower than FY2024 estimates due to the one-time nature of some FY2024 federal revenues as well as the end of enhanced Medicaid reimbursements launched during the pandemic. Even though FY2024 is estimated to end with a budget surplus of $422 million, FY2025 estimated expenditures were expected to exceed revenues by $891 million.5 Out years in the forecast also projected shortfalls due to expenditures growing faster than revenues.

The Governor’s proposed FY2025 budget, expected to be released on February 21, 2024, will show updated projections for both FY2024 and FY2025 based on additional data that have come in since the release of the Economic and Policy report in November 2023. As noted in monthly reports released by the Commission on Government Forecasting and Accountability in December and January, the economy has performed better than expected and that is been reflected in the state’s own revenue results. The Civic Federation will analyze the proposed budget this spring and release its findings ahead of the Illinois General Assembly’s passage of an enacted budget.

References

- Governor’s Office of Management and Budget, Illinois Economic and Fiscal Policy Report, November 15, 2023.

- Governor’s Office of Management and Budget, Illinois Economic and Fiscal Policy Report, November 15, 2023.

- Governor’s Office of Management and Budget, Illinois Economic and Fiscal Policy Report, November 15, 2023.

- Governor’s Office of Management and Budget, Illinois Economic and Fiscal Policy Report, November 15, 2023.

- Governor’s Office of Management and Budget, Illinois Economic and Fiscal Policy Report, November 15, 2023.